News

Ohio University shifts approach to budgets and financial forecast improves significantly

By: David Forster

Posted on:

ATHENS, Ohio (WOUB) — Just over a week ago, Ohio University’s board of trustees got a budget update that looks a lot different from what they’ve seen over the past couple of years.

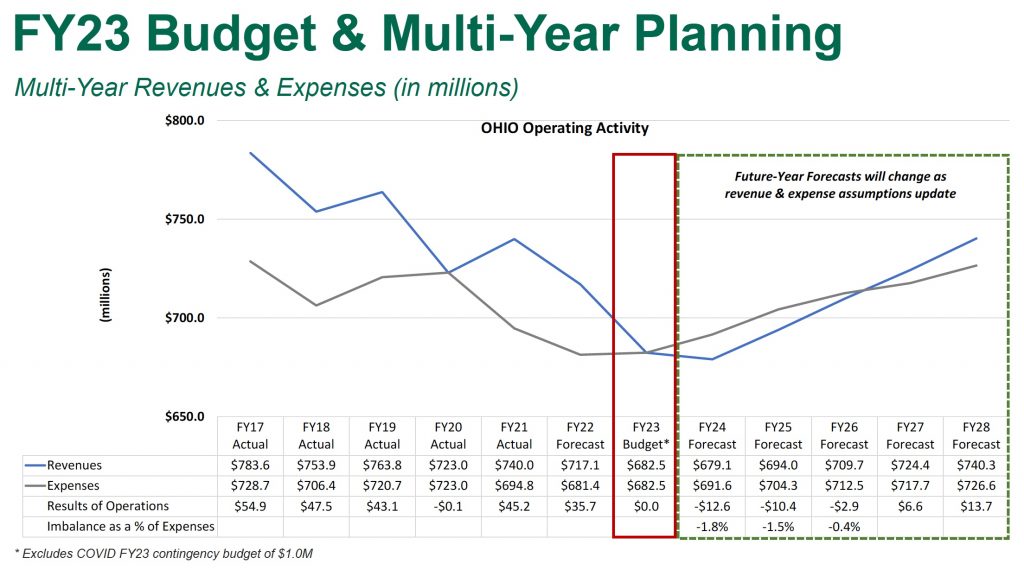

It projects a balanced budget next fiscal year and millions of dollars in budget surpluses a few years down the road.

This is a dramatic shift from just seven months ago at the trustees’ October meeting, when the forecast showed what appeared to be a nearly $30 million deficit next fiscal year and even bigger deficits the following years.

That October forecast looked like the ones the board has seen over the past couple of years, which consistently showed what looked like tens of millions of dollars in projected deficits for years into the future.

These forecasts came with warnings about a serious structural imbalance between revenue and expenses and the need to cut costs to close the gap.

How the university got a projected $29.7 million deficit for fiscal year 2023 down to zero in just seven months does involve some budget cuts to trim expenses.

But more than anything it reflects a fundamental change in the way the university is presenting its budget forecasts.

The biggest change is in how the forecasts treat use of money the university has saved in its reserves. Think of reserves as a savings account, said Kayla Righter, the university’s associate director for budget planning and analysis.

Some of that money set aside in reserves is spent on expensive capital projects, such repairing and updating buildings on campus, she said. These projects are planned years in advance and money is budgeted for them.

Money spent on these big capital projects was included under the expenses line in past budget forecasts, Righter said. A separate line showed the draw from reserves needed to cover the gap between revenue and expenses.

Most of this gap was caused by including these big capital outlays under expenses without also including the money from reserves set aside for them under revenue so that the two balanced out.

Instead, it ended up looking like the university’s revenue and expenses were way out of balance and tens of millions of dollars needed to be drawn from reserves each year to cover the deficit.

While some money in reserves has been used to cover actual operating deficits in a given year, Righter said, mostly it’s been used for planned spending.

Ohio University President Hugh Sherman asked that budget forecasts be changed so they instead reflect regular annual operating revenue and expenses when he took over last year, said John Day, the university’s associate provost for academic budget and planning. This change accounts for most of the big declines in the projected deficits.

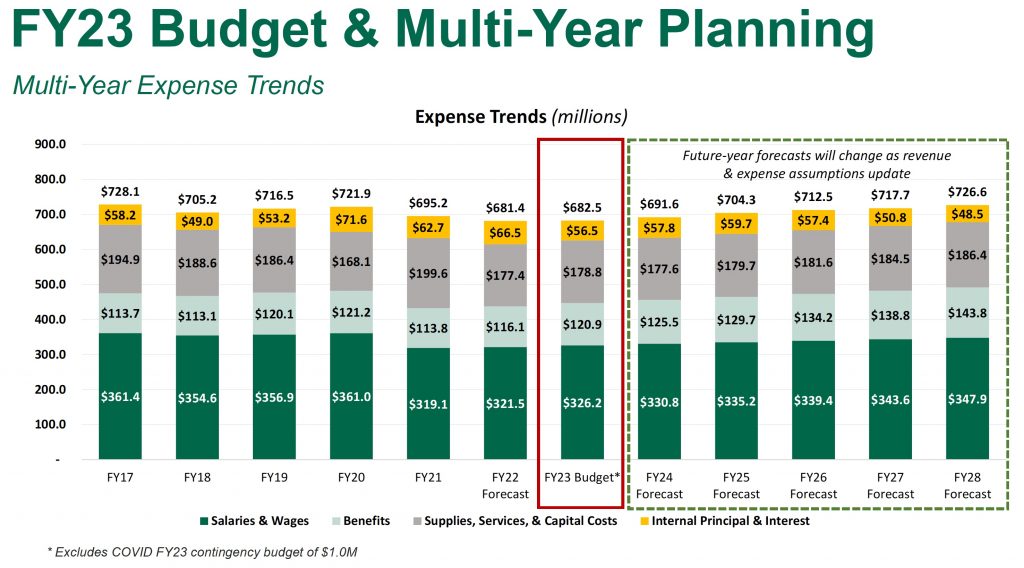

Another change that’s improving the financial outlook is in how the university budgets for vacant positions. It has been treating them as if they’re all filled, Righter said, meaning the budgeted salaries for all positions were counted as expenses even if those positions remained unfilled.

This also artificially inflated expenses in the budget forecasts. Looking back over the years, finance staff found that about 4 to 5 percent of budgeted positions are vacant in any given year, Righter said. So they are now only budgeting for 97 percent of positions, with a conservative assumption that 3 percent will remain vacant each year.

This represents about $10 million that no longer shows up under expenses, Righter said, which will help offset pay raises. The university last week announced a 2 percent raise pool for fiscal year 2023, which begins July 1, from which employees will receive a half-percent to a 4 percent bump in pay based on performance. The university is budgeting for 1.5 percent raises in subsequent years.

Each 1 percent raise equates to a little over $3 million in additional employee compensation, Righter said.

The updated fiscal year 2023 forecast also reflects savings because of employees who took the university up on its voluntary separation or retirement offer. The employees leaving over the next two years represent about $6 million in savings, with about $4.6 million next fiscal year and $1.4 million the year after.

The budget changes and savings have significantly improved the university’s financial outlook. But challenges remain.

After the projected balanced budget for fiscal year 2023, the university is forecasting three years of deficits: $12.6 million in fiscal year 2024, $10.4 million in fiscal year 2025 and $2.9 million in fiscal year 2026. A return to budget surpluses is expected starting in fiscal year 2027.

Behind these deficit forecasts are projections that revenue will continue to decline over the next two fiscal years before turning around. Meanwhile, expenses are projected to climb every year.

Righter said the university will continue looking for ways to bring revenue and expenses into alignment and shrink the projected deficits. “None of us is OK looking at a $12 million deficit,” she said of the fiscal year 2024 forecast.

Wages and benefits represent two-thirds of the university’s expenses. One of the big cost drivers in benefits is health care. In the seven months since the October budget forecast, the university has revised its projected benefits expenses upward by an additional $3.9 million for next fiscal year, $5.9 million for fiscal year 2024, $8.2 million for fiscal year 2025 and $10.1 million for fiscal year 2026. Much of the increase is tied to health care.

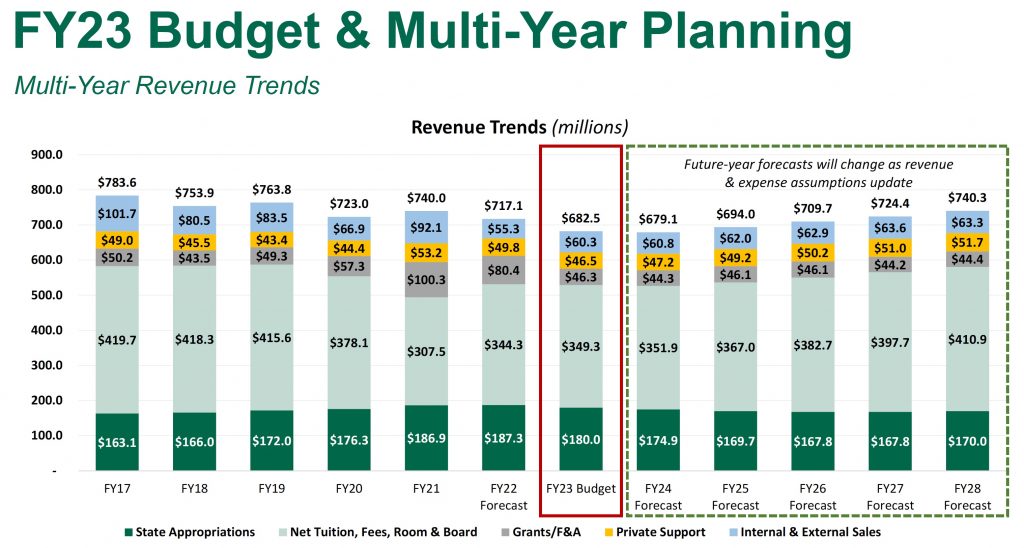

On the revenue side, enrollment drives about three-fourths of the university’s income. Enrollment is difficult to predict, and any budget projections based on enrollment forecasts should be taken “with a grain of salt,” Righter said.

One of the challenges Ohio University, like many other universities, faces is the growing cost of getting students to enroll.

Universities offer financial aid, typically discounts of the tuition sticker price, as an incentive to recruit students. The amount of these discounts is increasing as universities compete more aggressively for students.

Ohio University is now projecting $2.1 million more in undergraduate tuition revenue for the next fiscal year compared with its October forecast. But that gain is more than offset by a projected $6.4 million increase in financial aid since the October forecast. Similar offsets are projected for the next several years.

However, what the university loses in additional tuition discounts it more than makes up for with the increase in room and board revenue and funding from the state, which is also tied to enrollment.