House Bill 337 is Latest Effort to Reduce College Costs

By: Tiffany Goldstein

Posted on:

ATHENS, Ohio — A bill that would save university students money every semester is working its way through the Ohio House. HB 337, introduced by Ohio House Rep. Mike Duffey, would exempt textbook from the Ohio sales tax.

This is just the latest in a series of attempts to help cut higher education expenses.

At the beginning of the 2017-18 academic year, Ohio University created the Textbook Initiative Task Force to collaborate with academic departments and publishers of textbooks to discover the most efficient ways to reduce costs.

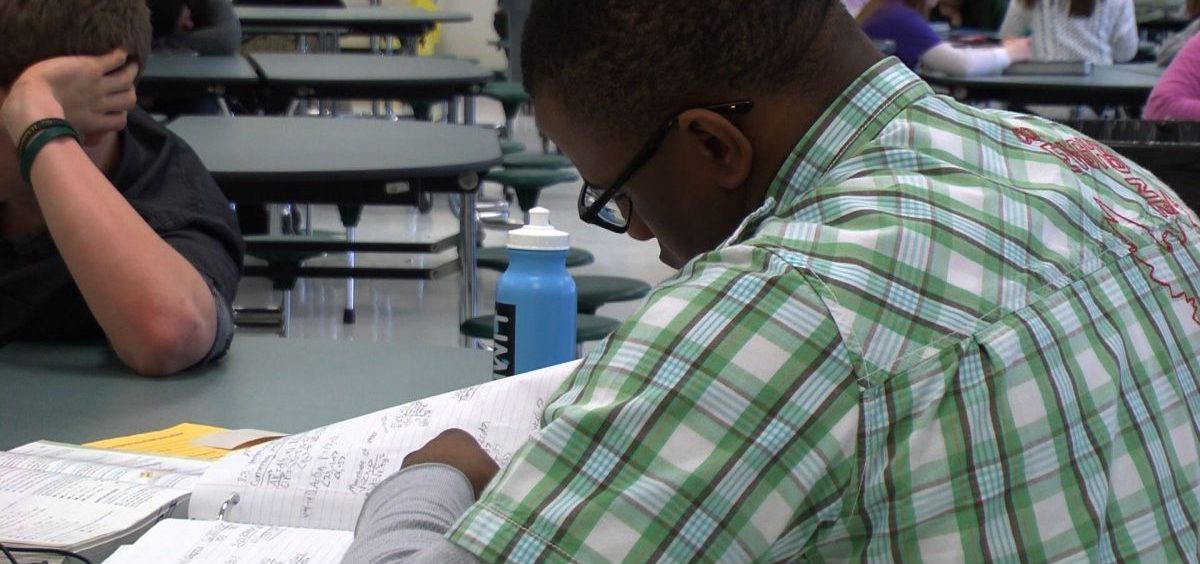

Student Textbook Spending

According to the Ohio Legislative Service Commission, Ohio students spent approximately $382 million on “required textbooks” last year. The Textbook Initiative Task Force at Ohio University is partnering with digital all-in-one platforms like Top Hat to save students money. This partnership is expected to save students $500,000 per semester.

Nerissa Young, Journalism Professor at Ohio University, said she switched to online textbooks to help students save money.

“Last Spring semester I made the jump and changed to digital,” Young said. “It probably saved students somewhere between $50-$200 a semester because I required a textbook and a workbook.”

Young utilized the content librarian at Alden Library to help with smooth the transition from print textbooks to digital textbooks.

“There is a lot available at Alden library that is digital,” she said. “Professors should really look into that because it would save them a lot of work because the library takes care of the copyright issue and most importantly, it will save the students money.”

While many are looking for a way to reduce the price of college textbooks, Ohio University Student Senate argued against the passage of HB 337.

Student Senate Perspective

The Ohio University Student Senate is currently supporting a bill that would exempt female menstrual products from the state sales tax. Jon Schlosser, Student Senate Chief of Staff said he fears support for HB 337 would distract from that effort.

“If our government affairs commissioner viewed it as a give or take, it could hurt our efforts in lobbying for the other bill,” he said. “We believe Ohio won’t do both.”

And Schlosser said he wonders if the $22 million in revenue lost from taxing textbooks would hurt other services offered by the state.

https://www.youtube.com/watch?v=ETQwIhvcORg