News

In a reversal, the Education Dept. is excluding many from student loan relief

By: Cory Turner | NPR

Posted on:

WASHINGTON, D.C. (NPR) — In a remarkable reversal that will affect the fortunes of many student loan borrowers, the U.S. Department of Education has quietly changed its guidance around who qualifies for President Biden’s sweeping student debt relief plan.

At the center of the change are borrowers who took out federal student loans many years ago, both Perkins loans and Federal Family Education Loans. FFEL loans, issued and managed by private banks but guaranteed by the federal government, were once the mainstay of the federal student loan program until the FFEL program ended in 2010.

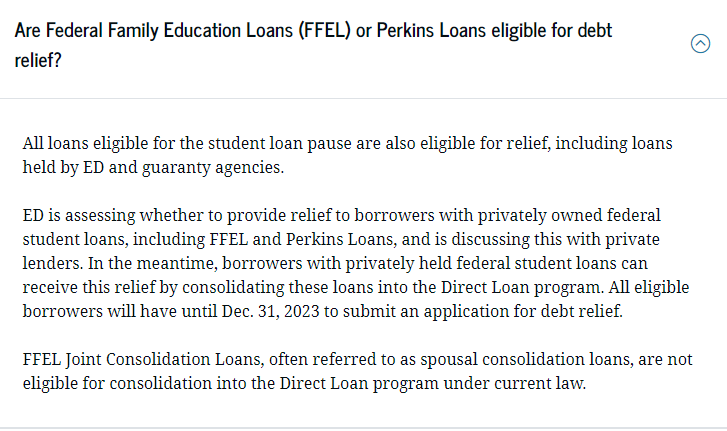

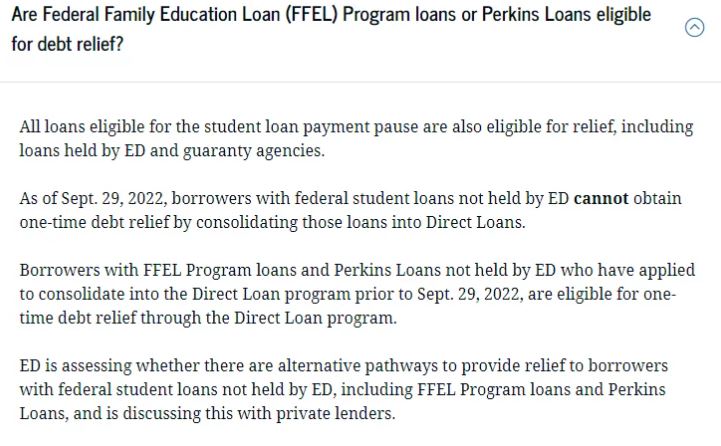

Today, according to federal data, more than 4 million borrowers still have commercially-held FFEL loans. Until Thursday, the department’s own website advised these borrowers that they could consolidate these loans into federal Direct Loans and thereby qualify for relief under Biden’s debt cancellation program.

An administration official tells NPR this change will not affect all 4 million borrowers with commercially-held FFEL loans. The official said many FFEL borrowers also have Direct Loans and so can still qualify to consolidate those FFEL loans, though that detail was not included in the department’s updated guidance.

Ultimately, this administration official says, roughly 800,000 borrowers would be directly affected.

It’s unclear why the department reversed its decision on allowing FFEL borrowers with commercially-held loans to consolidate and then qualify for debt relief.

In a statement to NPR, a department spokesperson says, “Our goal is to provide relief to as many eligible borrowers as quickly and easily as possible, and this will allow us to achieve that goal while we continue to explore additional legally-available options to provide relief to borrowers with privately owned FFEL loans and Perkins loans, including whether FFEL borrowers could receive one-time debt relief without needing to consolidate. Borrowers with privately held federal student loans who applied to consolidate their loans into Direct Loans before September 29, 2022 will obtain one-time debt relief. The FFEL program is now defunct and only a small percentage of borrowers have FFEL loans.”

The tell in that statement is “legally-available.”

Multiple legal experts tell NPR the reversal in policy was likely made out of concern that the private banks that manage old FFEL loans could potentially file lawsuits to stop the debt relief, arguing that Biden’s plan would cause them financial harm.

When FFEL borrowers consolidate their old loans into federal Direct Loans, these private banks essentially lose business. If these banks’ financial health depends, at least in part, on the assumption that they would be holding and profiting from these debts over the long-term, then losing borrowers to Biden’s debt relief plan could, possibly, constitute harm.

In fact, a new lawsuit filed Thursday by six state attorneys general, makes this very argument. One of the plaintiffs, Missouri, is home to MOHELA, which manages both federal Direct Loans and these old FFEL program loans.

“The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of an asset (the FFELP loans themselves) that it currently owns,” says the complaint. “The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of the ongoing interest payments that those loans generate.”

In response to the lawsuit, Persis Yu, of the Student Borrower Protection Center, says, “FFEL lenders have shown their true colors. Instead of working in the interest of student loan borrowers – their customers – these lenders are holding hostage relief to millions of borrowers in order to keep making a buck off of borrowers suffering.”

Changing the policy now, and limiting the number of FFEL borrowers who can conceivably qualify for debt relief, may make these FFEL banks less likely to legally oppose debt relief.

9(MDU1ODUxOTA3MDE2MDQwNjY2NjEyM2Q3ZA000))

Transcript :

JUANA SUMMERS, HOST:

Earlier today, the Biden administration quietly reversed course on who qualifies for the president’s sweeping student loan relief plan. Many borrowers who Biden had promised to help will now be left out. NPR’s Cory Turner spotted the change on the Education Department’s website this morning and joins us now. Hi, Cory.

CORY TURNER, BYLINE: Hey, Juana.

SUMMERS: So, Cory, what has changed here?

TURNER: Yeah. So this morning, I was looking over the department’s loan relief guidance for a very specific group of borrowers. These are people with Federal Family Education Loans. They’re known as FFEL loans. These are issued and managed by private banks, but they’re guaranteed by the federal government. And until this morning, the Education Department’s website said these borrowers could qualify for debt relief. They just needed to consolidate those loans into federally held direct loans.

But then I noticed, around 11:15 or so, that guidance completely changed. The website now says these borrowers do not qualify for debt relief unless they started the process of consolidating their loans before today, Juana. The big question – how many people are we talking about? – is complicated. We know roughly 4 million have these commercially held FFEL loans, but we also know that many of them will still qualify because they also happen to have direct loans. Just before coming on air, I spoke with an administration official who assured me the number is much lower – maybe around 800,000 borrowers – who could have qualified but now won’t. Part of this is we’ll wait and see.

SUMMERS: Cory, to me, this sounds pretty significant, but also, like, the kind of change that could put the administration in hot water with some people. Do you have any sense so far of what the rationale was behind the change?

TURNER: Yeah. An Education Department spokesperson told me, you know, our goal is to provide relief to as many eligible borrowers as quickly and easily as possible. And the department will continue to explore additional legally available options to provide relief to borrowers with privately owned FFEL loans. And, Juana, I think the tell in that statement is the words legally available. I have spoken with multiple legal experts who say this reversal was likely made out of concern that the private banks that manage these old FFEL loans could potentially claim financial harm and take the Biden administration to court.

SUMMERS: Cory, is that a legitimate concern? Are these lawsuits happening?

TURNER: Yeah, they have begun. Depending on how many borrowers consolidate, you know, these companies could see a lot of lost loans that they were planning on managing for years. In fact, just today, there was a new lawsuit filed by six state attorneys general, and it makes this very argument about one of these groups, called MOHELA. It’s a loan servicer that manages both federal direct loans and these old (inaudible) loans. And in the legal complaint, they say letting borrowers consolidate to get debt relief, quote, “harms MOHELA by depriving it of the ongoing interest payments that those loans generate.” And I think the department is worried that, you know, one of these banks or servicers could be granted legal standing in court and then ask the courts to freeze debt relief for everybody.

SUMMERS: Which would certainly be a big deal. OK, Cory, so the department is trying to dodge a lawsuit from one of these banks. But am I understanding you right that it’s possible that the right lawsuit could just complicate debt relief for everybody?

TURNER: I mean, it’s a possibility. And, you know, it’s one that a lot of conservatives are actively exploring right now. They see Biden’s debt relief plan as executive overreach. The big challenge for them is finding a plaintiff who can prove he will be harmed. We saw another lawsuit filed Tuesday by a borrower who said he didn’t want to take a big state income tax hit on his relief. In response, the department said borrowers can opt out. Now we have today’s move, likely trying to head off the claims of harm from some banks and loan servicers. Honestly, Juana, I think this is just beginning. I think, once we get the application from the Ed Department for debt relief, we’ll probably see several more lawsuits.

SUMMERS: We’ll check back in with you. NPR’s Cory Turner. Thank you.

TURNER: You’re welcome. Transcript provided by NPR, Copyright NPR.