News

After a Generation, Is There Finally a Fix for School Funding?

By: Kabir Bhatia | WKSU

Posted on:

KENT, Ohio (WKSU) — In laying out his proposed budget this month, Gov. Mike DeWine specifically said that the state legislature should do the heavy lifting when it comes to school funding. The state Supreme Court has been saying the same thing — for over 20 years. Our education series, “Learning Curve,” examines a $2 billion proposal to revamp how schools are funded in Ohio.

Just after Thanksgiving last year – during the “lame duck” session — the Ohio legislature voted on House Bill 305 to create a new school finance system.

“We have promised Ohio that we could do better. And we will. And we can,” said now-former Ashtabula Rep. John Patterson. “I ask you this afternoon, on this historic day, to make a decision that will impact Ohio for years to come.”

The bill received bipartisan support and passed 84-8 to a round of applause – but it never got a vote in the State Senate, where Republicans said school funding should be considered as part of the budget process.

Going from 305 to 1

That’s happening now: earlier this month — just as Gov. DeWine introduced his budget — two legislators re-introduced the “Fair School Funding Plan,” now with a high priority indicated by its new number: House Bill 1.

“It’s almost entirely the same bill that was introduced — and passed the House — last session,” says Rep. Bob Cupp from Lima. He’s been Speaker of the House since last July and was the other key sponsor of the previous bill with Rep. Patterson in the last session. This time out, Democrat Bride Rose Sweeney of Cleveland and Republican Jamie Callender from Concord are the sponsors. Cupp says the bill shifts the focus of funding to how much schools should get from the state.

“That, in the past, has generally been based upon the value of the property tax — duplicates the value of the property — in a local district. But property is only one measure of the ability to pay.”

Cupp says income is another measure.

“If residents have low income, their property values are low, they can have a high tax rate and it still won’t produce much money and it won’t support their schools and so that’s what it’s designed to kind of balance.”

Over the past several years, Cupp and Patterson assembled a group of school superintendents and treasurers from around the state to hash out a new formula. One of them was Akron Public Schools’ Treasurer Ryan Pendleton.

“It changes that linear relationship of the 610 districts in the State of Ohio and properly addresses the community’s ability to participate. So, if Akron’s relative tax is fairly high — and we have the lowest median income in the county — should we not be able to lower the tax burden on our individuals? And that answer is obviously ‘yes.’”

Akron v. Stow

Some districts – like Akron – will see a jump of about $39 million over six years. But next door, in the Stow-Munroe Falls School District, they estimate around $6.6 million. School officials say more would be useful, since they need to address things like aging facilities. The district’s newest building — the high school – was built in 1986 and needs around $39 million in updates. Rachel Brownridge has two daughters – a freshman and a junior – in high school, plus two sons who are recent graduates. She says building issues are a priority.

“Right now, my kids always joke there are climate zones in that building. They have to wear a sweater at one end and only a T-shirt at the other end because they’re sweating.”

A window into levies

Brownridge and her friend, Tracy Starnes, have both been involved as school volunteers for over a decade. Starnes also has a freshman and a junior in the district.

Both women say levies can be difficult in Stow: the district passed two last year, but those were only to fund day-to-day operations. Starnes says one proposed piece of the Fair School Funding Plan very much appeals to both of them: an online dashboard to show the public how district money is spent.

“I love the idea of the dashboard. I’m gonna say half the parents might go and actually look at it. We do get a lot of knee jerk reactions to things like that from parents. Senior citizens usually tell me, ‘oh this should all be covered and teachers make too much money’ — so they don’t want to vote for them.”

When it comes to funding under the new plan, there were concerns from Senate Republicans last year about the $2 billion price tag. When the House overwhelmingly passed its version of the bill last year, then-Representative Fred Strahorn of Dayton – a Democrat — urged his colleagues to work in the Statehouse and beyond to make the Fair Funding Plan a reality.

“Do what you have to do: get out, explain it to people, get the public to buy into it; do whatever you have to do, because this is about our children. This is about every kid being able to have a shot at being great.”

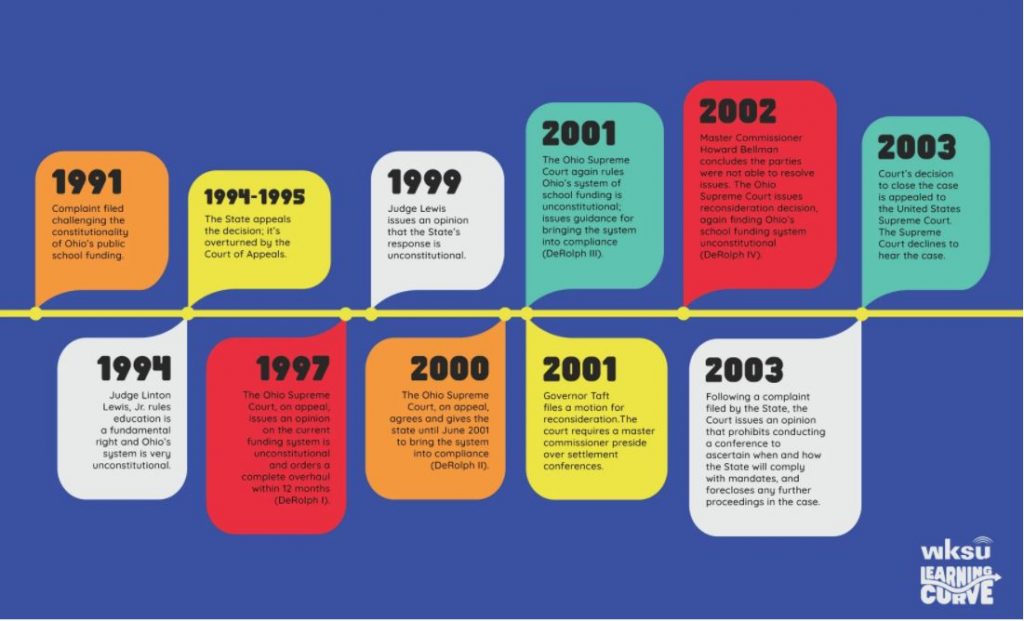

Strahorn added that during his nearly two decades in the state legislature, he’s seen politicians from both sides of the aisle try and fail to reform the state’s school funding formula – a formula which has been declared unconstitutional four times by the Ohio Supreme Court.

How did we get here?

Pendleton says, “we got the equation wrong about the reliance on local property taxes, shifting monies to wealthier districts or poor districts in the state, but it’s because we got the math wrong. There’s about 610 school districts in the State of Ohio, each with its own set of unique circumstances and size. From districts with seven kids — up in one of the islands on [Lake Erie] – to over 50,000 kids with Columbus City Schools.”

Pendleton says that accounts for the vast differences in funding under the current system.

“How it works now is, the state takes a look at all 610 districts and ranks them on a wealth scale. [For example in] Summit County, there’s 17 school districts — but that’s where this equation goes wrong and that this definition of wealth really skews both the legislature’s understanding [and] local communities understanding. It builds to distrust of this system that we operate today and why there’s such a need to have an overall. So we take the 17 districts in Summit County and wealth is defined by the amount of property divided by the number of kids.”

Residual budgeting

That tends to skew things in Ohio based on the tax someone pays, which is tied to the value of their property. Akron might have a relatively high per capita tax for schools compared to Hudson or Nordonia or Twinsburg, but if the property values are lower in Akron, that leads to lower collection for schools. Pendleton says there are many reasons this has gone on for so long without a fix.

“Residual budgeting, term limits, political will, lack of understanding. About five years ago, Cupp and Patterson got together and said, ‘this residually based, budgeted system — we’ve got to do better. We’ve got to do it right. We need to overhaul.’ What makes the Fair School Funding Plan different than other attempts before it [is] the previous attempts didn’t use practitioners. It was always bound by how much money is left in this budgeting process.

“We’re at the beginning of the biennium budget process. Think of all school districts and all the budget spending priorities for the State of Ohio. We get through the entire process and — because there’s no school funding formula — the Legislature says, ‘we will take $6,000 a kid and will add a little bit to that.’ Well, there really isn’t a formula to put that through. We don’t know what $6,000 per pupil really equates to. So that’s residual based budgeting. When the state doesn’t have a formula and they just kind of say, ‘well, here’s what money we have leftover.’

The new proposal from legislators asked Pendleton and his fellow school leaders to create a new formula.

“They chose eight superintendents and eight treasurers to design an overhaul from scratch: a new funding formula. They said to us, ‘you’re not going to see your individual district’s numbers. We want it to be a pure attempt. We don’t want that to taint any part of that.’ Because what happens is, we design a system, simulations come out, we have 610 different districts and different needs, and we all participate in that conversation, and then we start to dissect it. We’d say, ‘this doesn’t work; this doesn’t work.’ So these eight superintendents and eight treasurers – I’m honored to be one of those treasurers — we’re designing this system from scratch for all kids in Ohio.”

[Lauren Green | WKSU]