News

Ohio University Will End Year With A Surplus, But Cuts Expected As Big Deficits Loom

By: David Forster

Posted on:

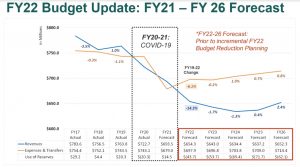

ATHENS, Ohio (WOUB) — Ohio University expects to end the fiscal year with a $14.5 million budget surplus, a dramatic shift from the big deficit projection just a few months ago.

But this rare dose of good news on the university’s budget front, delivered to the board of trustees at its meeting last week, was coupled with more grim forecasts for the coming years.

“I don’t love the numbers. None of us do,” Deb Shaffer, senior vice president of finance and administration, said of the projections for annual deficits of tens of millions of dollars starting next fiscal year.

Shaffer told the board the university’s senior administration continues to work on ways to “right-size” the university to bring expenses into alignment with declining revenues.

“We are in the middle of that,” she said. “We are certainly not done by any means.”

The projected surplus for this fiscal year, which ends June 30, is the result of significant infusions of federal stimulus money to address the economic disruptions of the coronavirus pandemic.

The university received more than $47.9 million this fiscal year from the federal coronavirus relief package passed last March. And it expects to receive $27.2 million from the new package passed last month.

This $75.1 million in federal aid offsets much of the $94.1 million in lost revenue and additional expenses the university absorbed so far this fiscal year because of the pandemic. For example, the university lost more than $37 million in room and board revenue and spent nearly $16.5 million on COVID-19 testing and contact tracing.

Meanwhile, the university saved millions of dollars through mandatory furloughs, which amounted to a temporary cut in pay for employees, through other cost-cutting measures and as a result of expenses it did not incur this fiscal year because so many students stayed home and took classes online.

The stimulus money and expense savings combined to create the projected budget surplus this fiscal year. But next year, the university will return to the structural budget imbalance that existed before the pandemic, Shaffer said.

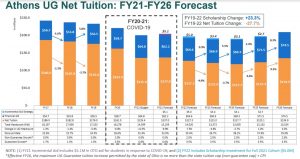

University administrators now project total undergraduate enrollment on the Athens campus for the coming school year will be a little over 13,700. This would be the lowest undergraduate enrollment since the mid-1980s.

Undergraduate enrollment is projected to continue dropping for another two years, bottoming out in the 2023-24 school year at around 12,600. This is about 6,000 students less than the enrollment peak in the 2016-17 school year.

As enrollment declines, so does tuition revenue.

The university could raise tuition to help offset the losses, but its options are constrained. The state limits how much tuition can be raised each year. Ohio University, like most others schools in the state, offers a tuition guarantee, meaning the tuition for each incoming freshmen class is locked in for four years. And Ohio University already has the second-highest tuition in the state. University officials have said this is a problem.

The university projects net undergraduate tuition revenue of $127.3 million for the coming school year, which is nearly $60 million less than the $186.9 million in the 2016-17 peak. Meanwhile, the university is offering more generous financial aid to compete for students, just as other universities are doing in a much more competitive market for students. This creates even more pressure on the bottom line because financial aid is really just a discount off the posted tuition price. The more aid the university offers, the lower its net tuition revenue.

The university projects it will spend $64.6 million in undergraduate financial aid awards for the coming school year, which is $10 million more than in the 2016-17 school year. To put this into perspective, the university is planning to spend $10 million more in financial aid to end up with about 4,900 fewer students than it had five years ago.

In recent years, the talk at board meetings was often about what the university could do to grow its way out of the budget slump. That talk was largely absent from last week’s meeting. University leaders and trustees focused on scaling down expenses, and the university itself, to fit a new enrollment and revenue reality.

“We are no longer assuming a higher level of growth,” Shaffer said. “We have to manage our expenses to the size of the institution we are today.”

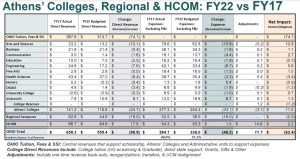

One of the slides presented to the board showed budgeted expenses for the next fiscal year for the university’s schools and colleges. The total was $48 million less than in fiscal year 2017, a drop in academic expenses of about 12.5 percent.

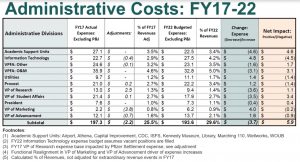

Cuts on the administrative side so far have not been as significant, which raised some eyebrows at the meeting. Budgeted expenses for administrative units next fiscal year are $3.7 million less than in 2017, a decline of about 1.9 percent.

Shaffer said spending is down in several of the administrative units, but there are some notable exceptions.

One is information technology, where budgeted expenses for the next fiscal year are up nearly $5 million over 2017. Shaffer said university leaders have been trying to shield information technology from cuts because of its central role in making the institution run. She also said the university had been underspending in this area and is now catching up.

Shaffer said the university has also invested more heavily in its marketing and recruiting operations in an effort to turn around the enrollment declines. Budgeted expenses for the marketing unit for the next fiscal year are up $4 million over 2017. Shaffer agreed, however, the administration needed to absorb a greater share of the budget cuts.

Trustee Matthew Evans to this point said the university needs to take a hard look at its administration operations as cuts are made “just as the academic side has had to make some hard decisions on some sacred cows” that have been a part of the institution for decades.

“There may be parts of the university that don’t make sense (anymore),” he said.