News

Ohio University Ending Year Strong Despite Pandemic, But Big Challenges Remain

By: David Forster

Posted on:

ATHENS, Ohio (WOUB) — Ohio University expected the pandemic to deliver a serious blow to its already fragile financial situation and leave it millions of dollars in the hole.

Instead, just the opposite happened. The university’s board of trustees was informed at its meeting Friday that the institution expects to end its 2021 fiscal year June 30 with a hefty surplus.

This financial boost, it turns out, is a direct result of the pandemic. And it will be short-lived. University leaders forecast a return next year to the chronic budget deficits brought about by a significant decline in enrollment over the past several years.

Deb Shaffer, the university’s senior vice president for finance and administration, told the board the goal was to “celebrate how we are coming out of this pandemic” but also to “make sure we are really focused on where we are headed.”

Dealing with COVID-19 was costly. Since the start of the pandemic in March 2020, the university has lost nearly $84 million in revenue and had to cover nearly $47 million in additional expenses.

That could have been devastating. Instead, a big chunk of the lost revenue and extra expenses were offset by over $79 million in federal pandemic relief aid the university has either already received or expects to receive.

The university also received nearly $18 million more in state funding than it was expecting.

It also saved tens of millions of dollars in operating expenses because it was shut down for months, and even after the campus reopened many classes remained online and many employees still worked from home.

For example, the university spent nearly $52 million less than budgeted on things like travel expenses, office supplies and equipment. It also opted not to fill many vacant positions, saving more than $27 million in wages and benefits.

The net result is a projected $60.6 million surplus to end the fiscal year. About $10 million of this will be used to refund the wages university employees lost because of mandatory furloughs imposed at the start of the fiscal year.

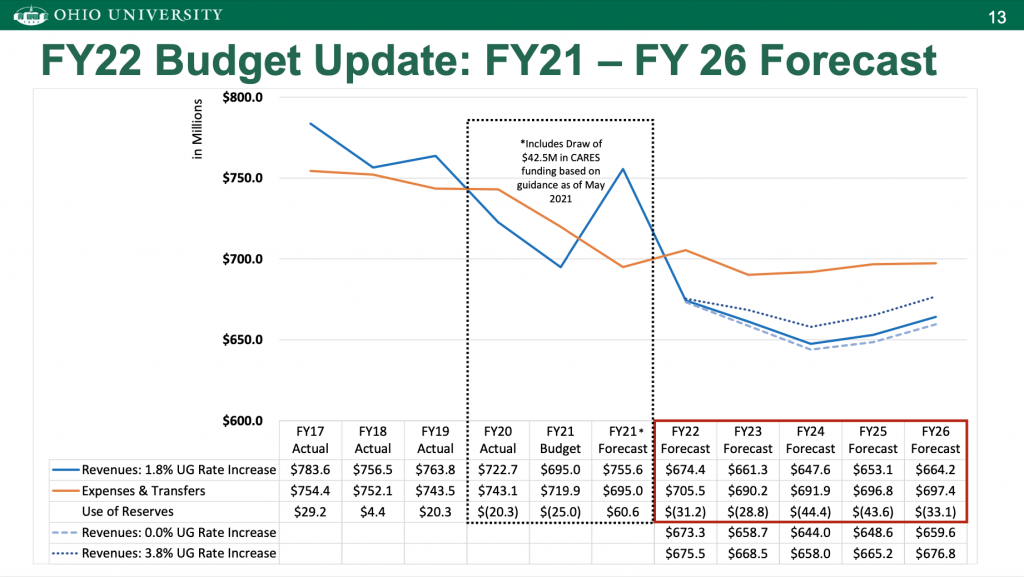

The surplus is a nice end to an otherwise lousy year. But as things return to normal next year, and the one-time boost from stimulus funds and expense savings recede, the university is again forecasting year after year of deficits unless something is done to bring revenue and expenses into alignment.

The projected budget deficit for the 2022 fiscal year, which starts July 1, is $31.2 million. It’s $28.8 million for fiscal year 2023, $44.4 million for fiscal year 2024, $43.6 million for fiscal year 2025 and $33.1 million for fiscal year 2026.

Most of the university’s revenue comes from tuition and room and board, which means it’s tied directly to enrollment. Enrollment has been declining for several years, which university leaders attribute to increasingly stiff competition for students from other universities in and outside of Ohio.

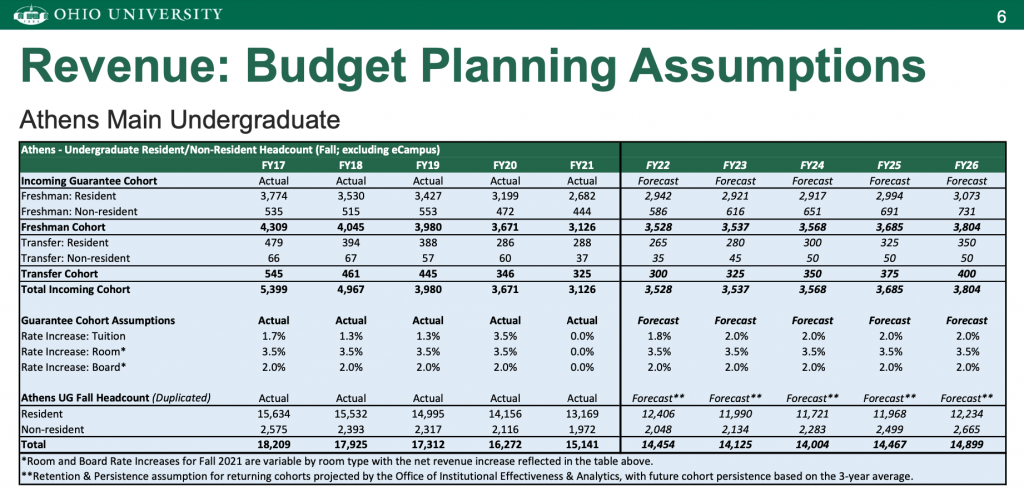

Freshman enrollment is up for the coming fall semester following a big pandemic-related drop last year. But it’s still well below pre-pandemic levels and it’s not expected to grow much over the next several years.

The university projects an incoming freshman class of 3,528. The projection four years from now, in fall 2025, is 3,804, which is almost back to where enrollment was a few years ago but still well below the peak years.

Much of this projected enrollment growth is expected to come from students outside of Ohio, which provides a bigger boost to the bottom line since they pay more in tuition. The university has recruiters stationed in different parts of the country and overseas to more aggressively target nonresident students.

Trustee Steve Casciani asked how much confidence university leaders have in their enrollment projections, noting that predictions in past years proved too optimistic and got the university into trouble.

Candace Boeninger, the university’s vice president for enrollment management, acknowledged that it’s not an exact science. “Our destiny is dependent on 17 and 18 year olds and the decisions made by them and their parents,” she said. The university is using much more sophisticated modeling than in previous years to make its predictions, she said.

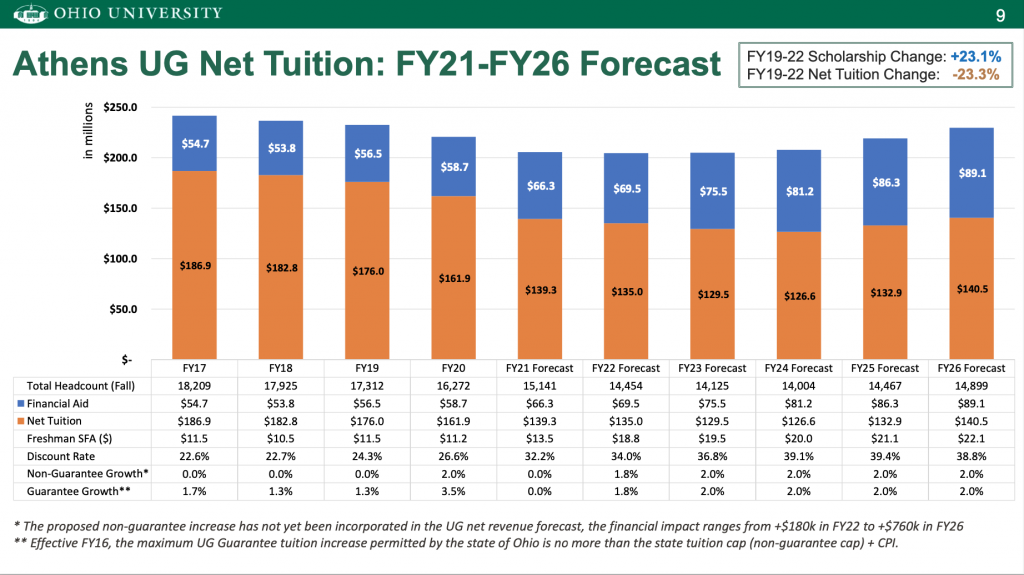

But the projected enrollment gains are offset in part by the fact that the university is spending a lot more in financial aid to get students here. The financial aid offered by colleges and universities is really just a discount off the tuition price, so the more that is offered in financial aid, the less the net tuition revenue.

When total undergraduate enrollment peaked at 18,209 in 2017, the university offered $54.7 million in financial aid. It plans to offer $69.5 million in financial aid this coming year and expects 14,454 undergraduates. The projections in fiscal year 2026 are $89.1 million in aid and 14,899 undergraduates.

To put this another way, the university is spending a lot more on financial aid on a lot fewer students. But so are universities around the state and the nation as the competition for students intensifies.

The university plans to raise tuition every year for at least the next several years to boost net tuition revenue. But there are limits on how much it can charge.

The state imposes a cap on tuition increases. And Ohio University already has the second-highest tuition in the state among public universities. So, there are limits on how much it can raise tuition and remain competitive.

The five-year plan is for a 1.8 percent increase this coming year followed by 2 percent increases each year after.

The university’s budget for the next fiscal year is not yet finalized. That usually happens at the June board meeting, but this year the university is holding off until August in part because of pandemic-related delays and also to wait for the state to adopt its own budget, which will impact some of the university’s decisions.