News

College aid letters are misleading students and need a legal fix

By: Elissa Nadworny | NPR

Posted on:

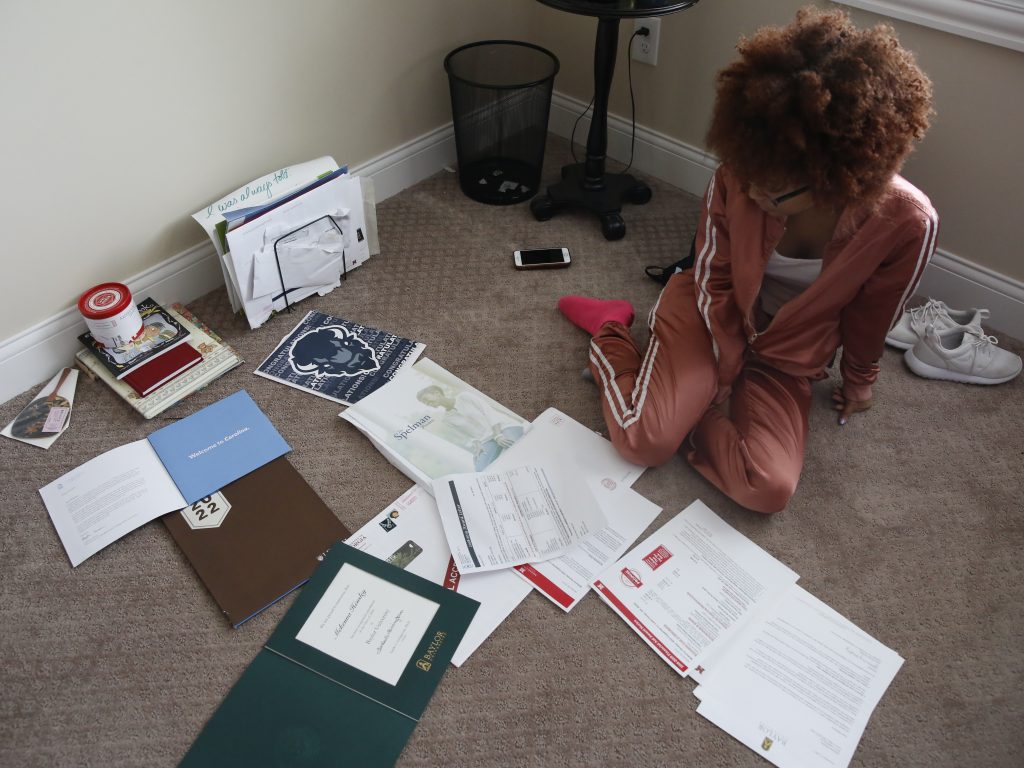

WASHINGTON, D.C. (NPR) — New federal research says colleges are failing to give accepted students clear and standard information about financial aid packages. The consequences can be extremely disruptive, including, for some students, dropping out of school.

“Colleges are not providing students the information they need,” says Melissa Emrey-Arras, who led the research by the U.S. Government Accountability Office. “And if colleges don’t do that, students can make decisions that are consequential for their futures.”

In addition to potentially leaving school, she said making the wrong decision because of unclear aid information can also lead to students borrowing more than they need to, which can affect them for years, or not buying textbooks, or even cutting back on food.

The GAO report found that at best, offer letters can be confusing, and at worst, they are misleading.

Here’s how it happens: When students get accepted to college, the school sends a document explaining how much financial aid the student is eligible to receive. Usually that’s some combination of grants, scholarships, work-study and federal student loans.

These documents come across as marketing material. Some numbers are bolded (you got a $20,000 scholarship!) while some numbers are missing (it costs $70,000 a year!). And every letter looks different, making it really difficult for students to compare offers from different schools.

“This is egregious and unacceptable,” said Rep. Virginia Foxx (R-NC) in a joint statement with Rep. Lisa McClain (R-MI), who have introduced new legislation to make financial aid offers transparent and easy to compare. “Colleges and universities must do better.” Foxx is the top Republican on the House Education Committee and requested the GAO report.

The problem has plagued students for years.

“A lot of institutions are using their financial aid offers as a way to present them in the rosiest financial light to get students to enroll,” says Rachel Fishman, who co-authored a 2108 report for New America, a public policy think tank, that analyzed more than 11,000 award letters from over 900 colleges, most of which were four-year institutions. “And what that ends up doing for students and families is it’s making it seem like college is more affordable than it actually is. And that’s a problem.”

The new GAO report looked at more than 500 financial aid offers from a nationally representative selection of colleges across the country, and found that colleges repeatedly failed to follow specific best practices.

For example, the GAO found the vast majority of colleges – 91% – did not include an adequate net price, which is how much out-of-pocket money the student or family will need to pay to attend, including through loans. More than half did not itemize costs and about a quarter (22%) of colleges did not provide any information about college costs in their financial aid offers, just listing aid.

Many failed to clearly label what aid money was free – like grants – and what students would have to pay back.

In past guidance to colleges, the U.S. Department of Education had provided a template for student aid letters. But the GAO found that only 3% of colleges used this template as their primary communication with students, and about two-thirds didn’t use the template at all.

“If you have a student or a prospective student who is applying to multiple schools, it makes it very challenging to compare offers across schools if they don’t have comparable information across those schools,” says Emrey-Arras.

Both Fishman and Emrey-Arras point to other situations when individual consumers are making big financial decisions, like taking out a mortgage or a credit card and buying health insurance. Those transactions require legal disclosures and standardized information to help individuals make an informed decision.

But federal college loans only require that students receive counseling before their money is disbursed, to understand their responsibilities as a borrower.

“Students usually have that entrance call counseling after they get the financial aid offer,” says Emery-Arras. “So it doesn’t actually hit at the point where the student is getting that financial aid offer and then using that to make a decision about which college to attend.”

Emrey-Arras says it’s a high bar for the GAO to recommend Congressional action, but the report says that’s the best next step.

“This is not an issue affecting a small number of colleges or a small number of prospective students and families,” she says. “This is an issue that is affecting 91% of colleges in the United States. We think that Congress needs to require colleges to provide this clear and standard information to prospective students and their families.”

Legislation to address this has come up in the past. The Understanding the True Cost of College Act, first introduced in 2012 and reintroduced last year, aimed to create a common disclosure for colleges so families and students could do apples-to-apples comparisons of financial aid offers.

It’s unclear when or if Foxx’s new bill, called the College Cost Transparency and Student Protection Act, may come up for a vote.

9(MDU1ODUxOTA3MDE2MDQwNjY2NjEyM2Q3ZA000))

Transcript :

AILSA CHANG, HOST:

All right. We all know that a lot of people have big debts after going to college, but how do they get into this mess? Well, new federal research blames, in part, the colleges for sending financial aid letters to students that are confusing and sometimes misleading.

Elissa Nadworny is here from NPR’s education desk. Hey, Elissa.

ELISSA NADWORNY, BYLINE: Hello.

CHANG: OK. So how do we think the current student debt crisis connects to these specific letters from colleges about financial aid?

NADWORNY: So when a student gets accepted to a college, the school typically sends them a letter explaining how much money they’re eligible to receive in grants, scholarships, work study and federal student loans. Every college’s letter looks a little different, making it really hard to compare. Colleges make them branded, like with school colors. There’s lots of exclamation points. These offers, they’re part of the pitch. They’re trying to convince students to enroll. And sometimes, as you said, they’re misleading. Several years ago, Rachel Fishman, a researcher at New America, looked at 11,000 of them.

RACHEL FISHMAN: Nobody did everything completely right. And then there was a few that did things egregiously wrong.

NADWORNY: So this issue’s been around a while. Back in 2019, the Department of Education told colleges to essentially clean up their act and gave them some direct instructions. First of all, you got to say how much it’s going to cost; be clear about what needs to be paid back and what’s free money; don’t call it an award, ’cause it’s not. But today, the U.S. Government Accountability Office, a federal watchdog, released a report that found colleges are not following the ed department’s guidance. And letters continue to be confusing and deceptive.

CHANG: Interesting. So how big is this problem?

NADWORNY: So the GAO found the vast majority of colleges – 91% – either did not include or miscalculated the net cost. So that’s how much out of pocket the student is going to need to pay. More than a fifth didn’t provide any info on college costs – nothing.

CHANG: Wow.

NADWORNY: Melissa Emrey-Arras, who led the GAO’s review, says this has big consequences.

MELISSA EMREY-ARRAS: Students can face huge surprises when they enroll in schools. They may have to take on large loans to deal with unexpected costs. They may cut back on essentials like food if they’re not expecting the costs. And they may even potentially drop out of college due to those costs.

NADWORNY: So she points to other moments where individual consumers are making big financial decisions; so taking out mortgages and credit cards, buying health insurance. Those have common legal requirements, standardized information to help consumers make the correct decision. And that doesn’t exist for student financial aid.

CHANG: So what happens now? Like, what recommendations does the GAO have?

NADWORNY: The GAO said since colleges didn’t follow the Department of ED guidance, that leaves Congress. Here’s Emrey-Arras from the GAO.

EMREY-ARRAS: We think that Congress needs to require colleges to provide this clear and standard information to prospective students and their families.

NADWORNY: So past legislation to do this hasn’t gone anywhere. But today, Representative Virginia Foxx, from North Carolina – she’s the top Republican on the House Education Committee. She said what colleges are doing is, quote, “egregious and unacceptable.” She was the one that actually asked for this research. And today, she’s introduced new legislation to make these offer letters more transparent.

CHANG: That is NPR’s Elissa Nadworny. Thank you so much, Elissa.

NADWORNY: Thank you, Ailsa. Transcript provided by NPR, Copyright NPR.