News

Still processing the 2024 election? Here are the highlights of Ohio local levy passages and failures

By: Kendall Crawford | The Ohio Newsroom

Posted on:

CINCINNATI (The Ohio Newsroom) — It’s been a week since Ohioans voted for sweeping statewide changes at the polls.

Republican Bernie Moreno defeated incumbent Democrat Sherrod Brown for a U.S. Senate seat. Three new judges were elected to the state’s Supreme Court. And Ohioans voted against creating a citizen-led redistricting board.

But there was a lot more on the ballot. Cities and townships across the state got the opportunity to vote on levies for fire and police services, public facilities and mental health services. More than 100 school districts and 20 local libraries asked their communities to raise taxes to support them.

Schools and libraries local levy results

This election, about a fifth of school districts had a local levy on the ballot to decide whether to raise taxes to support schools. Out of the 142 school districts, just half were successful in their bids.

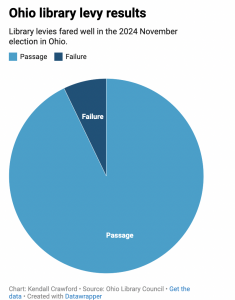

Libraries, on the other hand, saw more success. There were 28 library levies on the ballot. 26 of them passed.

“Overall, Ohioans showed that they consider their public libraries a priority and are willing to provide them with the financial resources necessary to serve their communities,” said Michelle Francis, executive director of the Ohio Library Council.

Many libraries say they’re struggling to keep programs running, according to reporting from the Ohio Capital Journal. The state’s share of funding for public libraries has dwindled over the years, leading more libraries to rely on local property tax levies to fill some of those gaps.

Progress for public transit local levy

Columbus will see a major change in their transportation infrastructure, now that central Ohio voters have passed Issue 47. It will increase the Central Ohio Transit Authority’s (COTA) share of the sales tax in Franklin County from .5% to 1%.

That money will go toward a $2 billion plan to create 14 transit lines over the next five years. Plus, it will fund three new Bus Rapid Transit lines and more than 500 miles of bike lanes, sidewalks and trails.

Columbus has long been one of the largest metro cities without rapid public transit, according to city leaders, marking a major change.

“I’m excited to see that Franklin County voters recognize the growth challenges our community faces and the steps needed to create a safe, equitable, and economically viable environment,” said Franklin County Commission president Kevin L. Boyce, who supported Issue 47.

Franklin County now ties Cuyahoga County with the highest sales tax in the state at 8%.

Small wins for weed

Some Ohio small towns are still voting on recreational marijuana sales, despite Ohioans voting to legalize the sale and use of recreational marijuana last year.

In the aftermath of the 2023 November election, many Ohio small towns, like Hubbard in northeast Ohio, have responded by banning the sale of recreational marijuana.

Hubbard voters got the final say on the matter in last week’s election. They voted to reverse the city’s ban and allow recreational marijuana sales. The ballot measure passed with 66% of support. Supporters say it could potentially bring a lot of tax revenue to the small town.

Lebanon in southwest Ohio also passed an issue to allow its medical facilities to offer recreational marijuana. While Brecksville, just south of Cleveland, banned recreational marijuana sales with the passage of Issue 7.

Local levy failures

The median property tax in the state has gone up in the last few years, so it’s no surprise that plenty of requests for money failed. Hamilton County, Cuyahoga County, Franklin County and Montgomery County all saw a surge in property value appraisals this year.

Boardman, a township outside of Youngstown, asked their community for a property tax increase to buy another ambulance. Township officials say Boardman has an aging population, in need of expanded emergency services. They believe relying on privately-owned ambulances has led to inconsistent emergency response times.

Owners with a home worth $100,000 would pay an extra $158 dollars per year in taxes. That proved to be too much for voters – 56% of which voted against the levy. Some opponents of the levy cited concerns of being overtaxed, according to reporting from The Vindicator.

North Canton and Franklin Township saw similar losses for their fire service levies. Those towns will have to go back to the drawing board on how to fund emergency services within their communities.