News

Pension Problems: Lawmakers Warn Of Economic Fallout From Failing Pensions

By: Becca Schimmel | Ohio Valley ReSource

Posted on:

United Mine Workers President Cecil Roberts fired up a crowd of thousands of union workers in Columbus, Ohio, with a simple chant: “Fix it!”

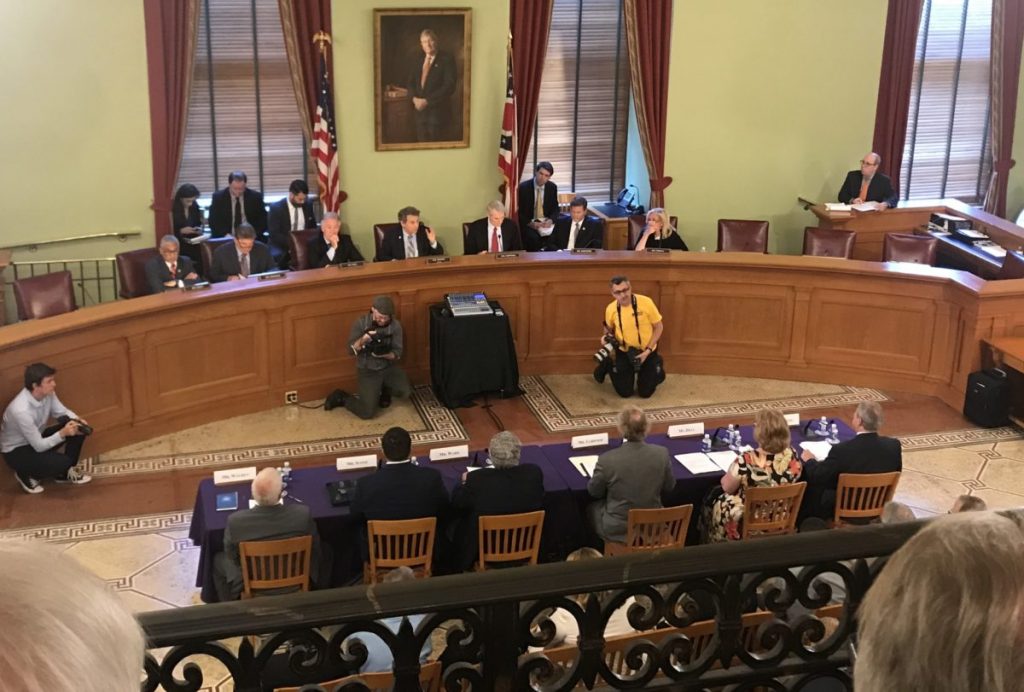

The rally last week came on the eve of a Congressional field hearing on problems plaguing multiemployer pension programs like the one retired miners depend upon.

“When the people get to marching, the politicians get to listening,” Roberts roared.

The UMWA warns that its pension plan could face insolvency if no action is taken, and it isn’t the only plan in trouble. Teamsters, iron workers, carpenters and others fear their pensions are shaky. As lawmakers on the Joint Select Committee on Solvency of Multiemployer Pension Plans explored the issue they heard warnings of dire effects if major pension plans fail — not just for employees in those industries but for the larger economy.

“Economic Contagion”

Sen. Rob Portman, an Ohio Republican on the joint committee, warned that if even one of the larger plans becomes insolvent that could put the Pension Benefit Guaranty Corporation at risk as well.

“That wave of bankruptcy has the potential to create an economic contagion effect,” Portman said. “In other words, it would spread around our economy.”

West Virginia Sen. Joe Manchin, a Democrat, echoed the concern that if multiemployer pension plans are allowed to become insolvent it could hit the whole U.S. economy hard.

“This one could take us down, quicker, faster and harder than anything that’s faced the United States since the Great Depression,” Manchin said. “I truly believe that. And I see this train wreck coming. I see the light in the tunnel and it is sure as hell not the daylight on the other side.”

Miner Discord

Mine workers had hoped that a bipartisan bill would address problems with both their pensions and health benefits. But as it made its way through Congress the bill was split and only health care benefits were secured.

Manchin later introduced another bipartisan bill to shore up the pension plan for more than 43,000 coal miners in Kentucky, Ohio and West Virginia, but the bill has not gained much traction on Capitol Hill.

Larry Ward is a retired miner and former president of his local union. He told the committee that a wave of coal company bankruptcies left more of the pension obligation on fewer employers. Existing companies are responsible for contributing to pension plans for people that worked for the now-orphaned companies.

“I think it’s well known, 80 percent of our retirees and widows are from orphaned companies and failure on the part of this committee to act now, our pension fund will go insolvent.”

Ward says one more downturn in the coal market could push the UMW plan into insolvency.

Business Perspective

Employers in other industries are looking at similar problems. David Gardner is the CEO of Alfred Nickles Bakery in Ohio. His employees are part of the Bakery, Confectionery, Tobacco Workers & Grain Millers union.

“Why should our company have to fund the pensions of people who never worked for Nickles Bakery?” Gardner asked.

Gardner said his company was turned down for loans because of the unfunded pension liability. He says business owners are stuck if they can’t negotiate pension increases.

“Is it fair for multiemployer funds to put companies out of business due to rehabilitation plans that require huge contribution increases per employee per week?” Gardner asked.

Striking a Balance

Sen. Portman said one of the questions the committee has to answer is how to strike the right balance, not only on the bipartisan panel but also with the American people. He said the committee has to figure out how much money should come from taxpayers who have no stake in the pensions.

“Let’s be honest with each other today. About 99 percent of the taxpayers who are going to be asked to contribute to something through the government … are not in these affected plans,” Portman said.

Sen. Sherrod Brown, an Ohio Democrat, said there are more than 60,000 active workers and retirees in his state who could lose their pensions if nothing is done. Brown said workers now paying into pensions might not see a penny of that money if Congress doesn’t act.

“It threatens our economy, it affects every American, every state in this country. It affects union workers, it affects non-union workers,” Brown said.

Brown has introduced a bill to establish a system in the Treasury Department for pension plans to borrow enough to remain solvent.

ReSource reporter Aaron Payne contributed to this story.