News

Central Ohio bank reaches a settlement with the U.S. Justice Department for redlining

By: Jo Ingles | Statehouse News Bureau

Posted on:

COLUMBUS, Ohio (Statehouse News Bureau) — The federal government has reached an agreement with a Central Ohio bank for redlining practices. That an illegal practice of discrimination by lenders against minority populations by discouraging home loan applications, denying access to home loans or avoiding providing other credit services for those groups.

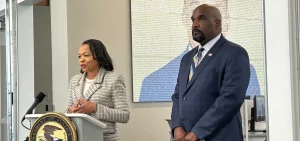

Assistant Attorney General Kristen Clarke with the US Department of Justice’s Civil Rights Division said the bulk of this $9 million settlement, $7.75 million dollars, will be put into a fund to help minorities buy homes in the future.

“That will help borrowers of color access credit and they’ll open new offices to service the needs of the Black and Hispanic communities in Columbus,” Clarke said.

The complaint alleges Park National Bank’s branches and mortgage lenders were in Columbus-area neighborhoods that were mostly white, and that the bank didn’t “take any meaningful measures” to make up for not having branches in communities that were mostly Black or Hispanic. The bank has agreed to open a branch and a mortgage loan office in a mostly Black or Hispanic neighborhood.

Clarke said this settlement is one of several that have been offered through the DOJ’s initiative to crack down on redlining.

“Never before has the department resolved so many redlining cases in such a time frame and with this extent of financial relief for impacted borrowers,” Clarke said.

The bank has also agreed to conduct a study to help determine the needs for financial services for minority neighborhoods in the Columbus area.

“We must eliminate modern-day redlining, root and branch. This is about insuring racial justice, economic justice, and equal access to opportunity for all communities in our country,” Clarke said.

“Let today’s settlement send a clear message to banks and financial lending institutions in the Southern District of Ohio that we will not tolerate discriminatory lending practices,” Parker said.

In a written news release, Park National Bank Chairman and Chief Executive Officer David Trautman disagreed with the suggestion that any intentional discrimination took place, but said the bank is “united with the DOJ in our commitment to ensuring equal access to credit for all consumers.”

“We condemn discrimination in any form and stand firm in our commitment to providing equal access to credit for all borrowers. We look forward to creating even more opportunities for individuals and families to achieve the dream of home ownership,” Trautman said.

The news release states Park National Bank has supported affordable housing, including financing, construction, rehabilitation and preservation for many years. And it says since 1991, Park has committed more than $188 million for low-income housing tax credits.