You are viewing the "Child Tax Credit" Archives

A Republican lawmaker’s proposal expands Ohio’s child tax deduction to expectant parents

By: Karen Kasler | Statehouse News Bureau

Posted on:

COLUMBUS, Ohio (Statehouse News Bureau) — A conservative Republican state lawmaker wants to expand the child tax deduction to people who are expecting, not just to parents. With just a… Read More

With child nutrition waivers expiring, school leaders fear kids will go hungry

By: Liam Niemeyer | Ohio Valley ReSource

Posted on:

Ohio Valley ReSource · With child nutrition waivers expiring, school leaders fear kids will go hungry MAYFIELD, Ky. (OVR) — Pizza is on the menu at Mayfield High School, a… Read More

Why America has been so stingy in fighting child poverty

By: Greg Rosalsky | NPR

Posted on:

WASHINGTON, D.C. (NPR) — It was heralded as a game-changer for America’s social safety net. It dramatically reduced child poverty. But, last month, the enhanced Child Tax Credit — a… Read More

The expanded child tax credit briefly slashed child poverty. Here’s what else it did

By: Cory Turner | NPR

Posted on:

WASHINGTON, D.C. (NPR) — Blink and you could have missed it. For six months, the United States experimented with an idea that’s new here but is already a backstitch in… Read More

Families are in distress after the first month without the expanded child tax credit

By: Deepa Shivaram | NPR

Posted on:

WASHINGTON, D.C. (NPR) — Had Congress renewed the expanded child tax credit at the end of last year, Jen Cousins would have received $1,000 from the government on Jan. 14…. Read More

Families Receive Sorely Needed Child Tax Credit Payments

By: Kaitlin Thorne | Ohio Valley ReSource

Posted on:

BUCHTEL, Ohio (OVR) — The Robsons, like the vast majority of U.S. households with children, began receiving the Child Tax Credit last week – the latest part of the American… Read More

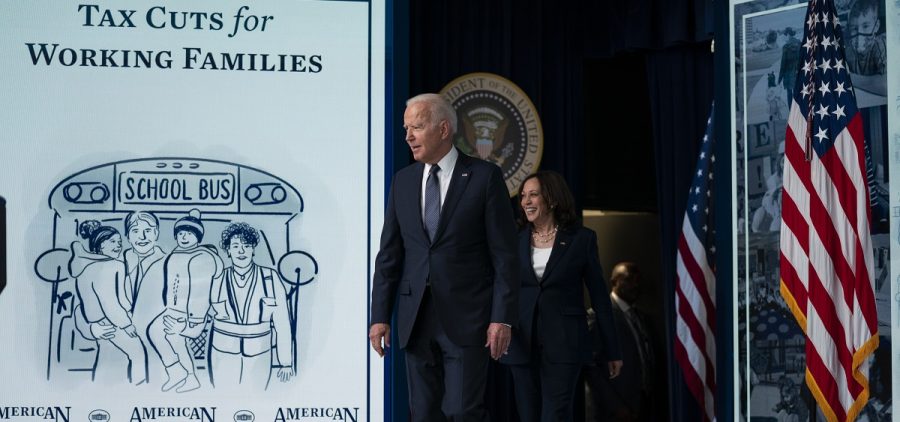

What The New Monthly Child Tax Credits Mean For You And Your Family

By: Vanessa Romo | NPR

Posted on:

“For working families with children, this tax cut sends a clear message: Help is here,” said President Biden, touting the tax credit that gives American families up to an extra $1,600 per child.