News

Professor Sees Flaw In Argument That Energy Bill Is A “Tax Increase”

By: Andy Chow | Statehouse News Bureau

Posted on:

A debate is brewing over whether a group can put the state’s new nuclear bailout bill before voters next year as referendum. The dispute questions if the increased rate on electric bills should be considered a tax increase.

A Columbus law firm argues that the new energy law charging electric customers up to $2.35 a month for nuclear, coal, and solar subsidies is a tax increase.

“Here, the charges levied under HB6 are imposed by the legislature, upon a broad class of parties, and for a public purpose,” writes John Zeiger, attorney with Zeiger, Tigges, and Little.

The memo was sent to the Ohio Secretary of State’s office in hopes of thwarting an attempt to put a referendum of the energy bill on the 2020 ballot. Under the Ohio Constitution, voters cannot reject a tax increase through a referendum.

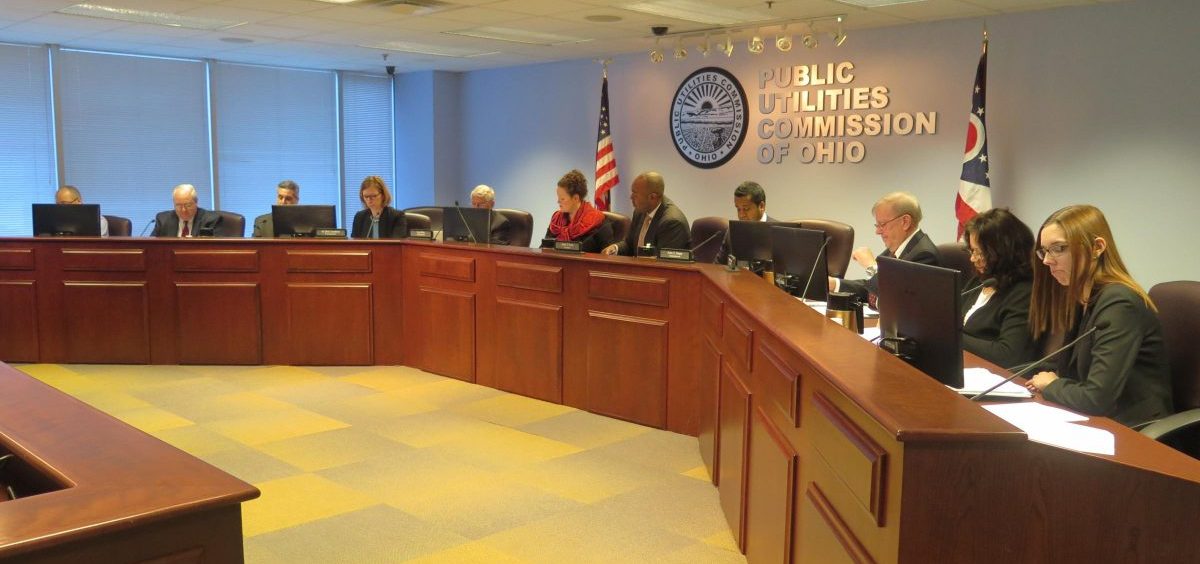

Ned Hill, an energy economics professor for Ohio State University, does not agree with that line of thinking. He says, if that were the case, then the Public Utilities Commission of Ohio has approved several tax increases over the years.

“All the other non-bypassable riders that have been larded onto your electricity bills over the past six years are also taxes and maybe legally questionable,” says Hill.

Hill, who wants a referendum to overturn the bailout law, points out that many supporters of the bill argued against the claim that it was essentially a tax increase. Hill himself called it a de facto tax increase in committee testimony, however, he says he was careful not to officially label it a tax increase.

Ohioans Against Corporate Bailouts is the group trying to put a referendum on the ballot.

“It’s a bogus, desperate attempt to deny Ohioans their Constitutionally guaranteed right to vote on controversial legislation. Utility charges to consumers are fees in exchange for services provided to consumers by the company, not taxes,” says Gene Pierce, spokesperson for Ohioans Against Corporate Bailouts.